Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

Advantages of filing 2290 Electronically with our Software

Receive Stamped Schedule 1 in Minutes

Guaranteed Schedule 1 or

Your money Back

Free VIN Correction

Retransmit Rejected Returns for Free

Claim Tax Credits

Supports 2290 Amendments

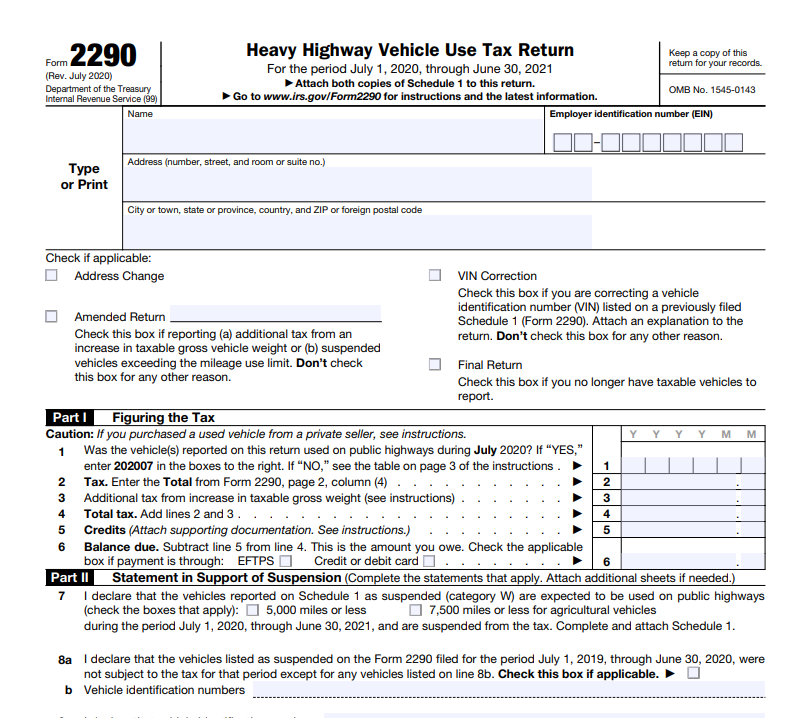

Form 2290 - An Overview

Form 2290 is a simple federal excise tax form filed by truckers whose vehicles have a taxable gross weight of 55,000 pounds or more. Truckers must complete 2290 and file the HVUT Form 2290 for the period from July 1st to June 30th.

To complete Form 2290, you need to have various details such as your business name, EIN, address, and details of the authorized signatory.

In addition, you need to provide the vehicle’s VIN as well as the gross taxable weight.

Visit https://www.expresstrucktax.com/

hvut/irs-form-2290/ to learn more

about IRS Form 2290.

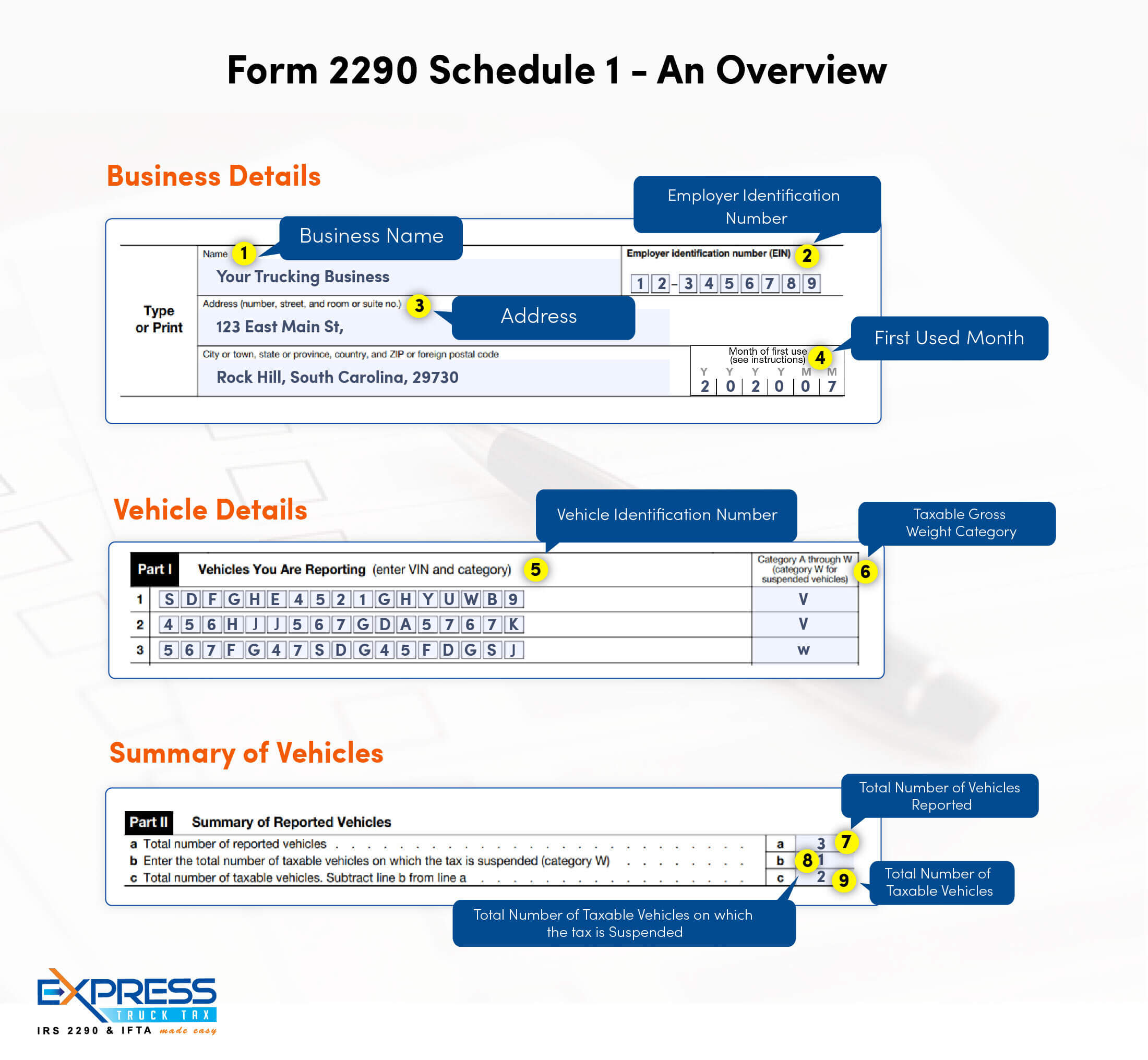

Form 2290 Schedule 1

Once the Form 2290 is filed with the IRS, you will get back the stamped 2290 schedule 1, which can be used as HVUT proof payment to register your vehicle with any state DMVs or to renew your tags. Also, Schedule 1 is mandated to run vehicles on public highways.

If you have filed your e-file Form 2290 with 2290electronicfiling.com, you will receive your Stamped Schedule 1 directly to your email. You can also opt to receive your 2290 schedule 1 via fax or postal mail. And we at 2290electronicfiling.com, will directly send your 2290 schedule 1 to your carrier and simplify your 2290 filing needs.

In addition, you need to provide the vehicle’s VIN as well as the gross taxable weight.

Visit https://www.expresstrucktax.com/

hvut/form-2290-schedule-1/ to learn more about the Stamped 2290 Schedule 1 and its importance.

IRS HVUT Form 2290 Due Date

Form 2290 needs to be filed every year by August 31st for each of the taxable vehicles used on the public highway for the current tax period.

The current tax period for Form 2290 starts on July 1 and ends on June 30.

Please note that you need to file Form 2290 once the vehicle is placed in service.

The due date to file Form 2290 will be the last day of the month following the month that the vehicle was first placed on the road.

Note : If any Form 2290 due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

Visit https://www.expresstrucktax.com/

hvut/irs-form-2290-due-date/ for a complete Form 2290 due date chart.

How To File Form 2290 Electronically?

Add Business Details

Enter Vehicle Details

Review & Transmit to the IRS

E-File Your Heavy Vehicle Use Tax Form 2290 For The 2023-2024 Tax Year!

Visit https://www.expresstrucktax.com

/hvut/e-file-form-2290-online/ to learn about filing Form 2290 electronically with the IRS.